The overall number of business aviation private flights was up 5% in 2022, compared to 2021, to reach a new record level. There was growth in all categories from Part 91 whole ownership, to Part 135 charter and Part 91k fractional ownership.

2022 Business Aviation Growth

The 2022 data from ARGUS Traqpak shows the overall 5.0% growth in business aviation flight numbers breaks down as 6.4% growth in Part 91 flights, 1.4% growth in Part 135 flights and 6.6% growth in Part 91k fractional flights.

Looking at 2022 compared to the past few years the growth in total flights and by category is shown in the table below:

| Years | Total | Part 91 | Part 135 | Part 91k |

| 2022 v 2021 | +5.0% | +6.4% | +1.4% | +6.6% |

| 2022 v 2020 | +51.8% | +46.0% | +51.6% | +65.6% |

| 2022 v 2019 | +15.5% | +4.2% | +24.7% | +28.6% |

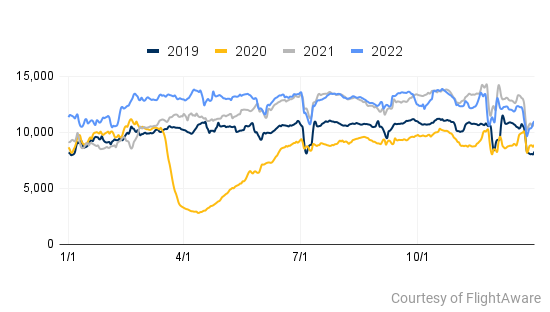

You can see that 2020 was the year that was really impacted by Covid, and private flights dropped off significantly, as did all other travel, hence the large 51.8% bounce back from 2020 flight numbers. This is also very clear in the graph below of business aviation flight numbers by year, coutersy of FlightAware. The graph shows the flight numbers for 2019, 2020, 2021 and 2022. The blue line, 2022, was at record levels during the first half of 2022. But in the second half of 2022 the flight numbers were more in line with 2021 and ARGUS reports that for December 2022 the North American market reported a 6.2% yearly decrease in activity from December 2021 but remained up 12.7% from the pre-covid December 2019 levels.

Commenting on the overall results for 2022 and looking into 2023, Travis Kuhn, SVP, Market Intelligence at ARGUS told SherpaReport “Overall 2022 flight activity finished up 5.0% from 2021 but activity was calmer in the 2nd of half of the year as it operated at more sustainable levels within its current capacity. As we look at 2023 our forecast has activity remaining mostly flat for the year, down 0.9% in 2023 when compared to 2022. At these levels we’re still up 15% from 2019 and North American business aviation remains very robust.”

This article discusses the ten largest private aircraft operators in 2022.