The fractional aircraft operators in North America flew over 833,000 hours in 2022. This was an increase of more than 7% compared to 2021, and up about 65% compared to the reduced pandemic levels in 2020. The largest fractional operators, including operators of both jets and turboprops, are ranked and discussed below.

Size Rankings

The table below shows the largest fractional aircraft companies in North America ranked by number of flight hours in 2022. The data is courtesy of ARGUS.

| Operator | 2022 Hours | 2021 Hours |

| NetJets | 511,224 | 478,444 |

| Flexjet | 183,548 | 178,053 |

| PlaneSense | 44,593 | 42,907 |

| AirSprint | 27,233 | 19,032 |

| Airshare | 24,040 | 20,955 |

| Nicholas Air | 21,594 | 18,023 |

| Jet It | 18,500 | 11,290 |

The order of the rankings is pretty much the same as in the last few years, with NetJets very much the largest fractional jet operator, representing more than 61% of all the hours flown, and second place Flexjet accounting for over 22%. So a combined 83% of the market between the two of them.

Monthly Trends

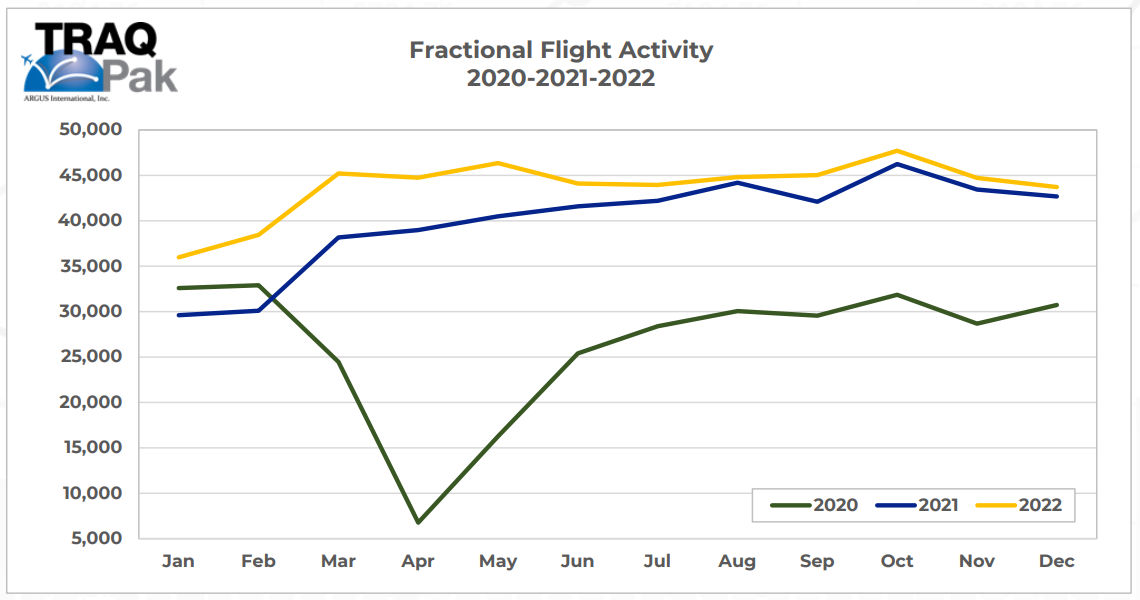

The overall fractional flights by month started to recover to pre-pandemic levels in the early part of 2021 (blue line below), and continued rising throughout that year. In 2022 (yellow line below) the overall fractional flight hours and flight numbers continued to grow in the early part of the year, but levelled off towards the end of the year. You can see the massive COVID inflicted drop in April 2020, the quick bounce back and then ongoing rise in demand.

For the year as a whole, fractional aircraft flight hours in 2022 were at record levels and well above (pre-pandemic) 2019 levels.

In addition to selling fractional shares, most of these fractional operators also offer jet cards on the planes in their fleets, and the hours here represent flights for both fractional owners and jet card holders. Many of the fractional (Part 91k) operators also have a Part 135 charter certificate, but in this data analysis all flights by a given fractional operator are assumed to be Part 91k.

NetJets

NetJets is by far the largest private aviation operator with over 900 aircraft worldwide, including managed aircraft (through Executive Jet Management) in addition to its fractional fleet. It has been rapidly growing this fleet over the last couple of years and is adding more new aircraft in 2023. At the end of 2022 it announced an order for the new Global 8000, to become the fleet launch customer for the latest ultra long range aircraft from Bombardier. But even with these additions NetJets has said that its inventory is sold out through 2023.

The company paused jet card sales in mid-2021 citing “today’s unprecedented flight demand” and noting that this “allows us to continue prioritizing what is most important - delivering the best possible experience to all Owners.” The card program is still currently limited to existing Owners, but as an alternative, in 2022, the company launched a 3 year, 25 hour per year lease program.

Flexjet

In 2022 Flexjet announced plans to become a public company, which will also include sister operating units Sentient Jet, FXAIR and Private Fly, plus several other private aviation companies. Flexjet has been the second largest fractional aviation company for a number of years.

The total Flexjet fleet is over 250 aircraft, with about 235 jets in its fractional fleet, plus 19 Flexjet helicopters and has a further 17 aircraft for which it has guaranteed exclusive dedicated capacity. It has also been rapidly growing the fleet over the last few years. In discussing plans to go public, Flexjet noted that over 35% of fractional customers have been with the company for more than 10 years and 55% have been with the company for more than five years

PlaneSense

PlaneSense operates the largest civilian fleet of Pilatus PC-12 turbo-prop aircraft in the world, and in 2018 added the Pilatus PC-24 light jet to its programs. The total fleet is now about 50 aircraft. SherpaReport visited PlaneSense headquarters last year and saw their flight operations, maintenance, pilot training and customer service areas.

AirSprint

Calgary, Alberta based AirSprint has the largest fractional fleet in Canada, with about 30 aircraft, including the Embraer Praetor 500 and Legacy 450, Cessna Citation CJ2+ and Citation CJ3+. The company has added several aircraft and grown its fleet significantly over the last few years.

Airshare

Airshare offers both fractional shares and their Embark jet card, which both provide day based (rather than hours based) access to their fleet of Phenom 300 light jets and Challenger 350 super midsize aircraft. The company also used to offer the smaller Phenom 100, but has recently been phasing out these light jets and adding more Challengers.

Nicholas Air

Oxford, Mississippi headquartered Nicholas Air operates a range of aircraft from the Pilatus PC-12, to Phenom 100 and 300, Citation CJ3, Citation Latitude, and Challenger 300. The company offers shares, leases, cards and aircraft management.

Jet It

Fast growing Jet It offers fractional ownership on a fleet of HondaJets and Phenom 300s. They have a day based program, for instance a 1/10th ownership share provides 25 days of flight time a year. A very unique feature of their program, the "Red Jet Squadron", helps owners who are pilots to become type rated in the HondaJet. These owners can then pilot their HondaJet Elite with one of Jet Its' trained captains.

If you want detailed comparisons of the fractional programs become a SherpaReport member here.

Looking into 2023, ARGUS Traqpak analysts are forecasting a fairly flat level of flight activity in 2023 for total private aviation, including fractional flights, compared to 2022 numbers.

Many of the fractional operators are also amongst the largest private aircraft operators, with NetJets and Flexjet being the top two in both lists. In comparison, this article covers the largest private fractional operators in 2021.