The interest in electric vertical take-off and landing (eVTOL) aircraft continues to climb. There are numerous aircraft that are in development and testing, with billions of dollars being invested in their evolution - they will potentially have a huge impact on both commercial and private aviation. This article looks at the overall market and some of the leading contenders.

The eVTOL Market & Vision

First, the surprising news: according to the eVTOL market research report of July 2023, the market for electric-vertical-takeoff-and-landing (eVTOL) aircraft could be worth around $23.4 billion in 2035, one decade after the first eVTOL air taxis are slated to enter service.

The report also states, “Compared with other regions, the European market is expected to have the highest growth rate and will hold the largest share of the market. According to the report, Europe’s eVTOL market could be worth $4.9 billion by 2035, growing at a CAGR of 56.8 percent. The authors cite recent economic development and government commitments to sustainability as driving factors contributing to the eVTOL market in Europe.”

The study found that fully electric aircraft will account for the largest share of the market, compared with aircraft with hybrid-electric or hydrogen fuel cell-powered propulsion systems. The report also states that the market for aircraft with a range of more than 200 kilometers (124 miles) will grow faster than the market for eVTOL vehicles intended to operate at shorter ranges.

Finally, according to the report, the market for aircraft with vectored-thrust propulsion systems - like those built by Joby, Archer, Lilium, and Wisk - is expected to account for the largest portion of the market, compared with multicopters and lift-plus-cruise configurations. Aircraft with vectored thrust designs have rotors that can tilt to change the direction of thrust, whereas lift-plus-cruise configurations - such as those being developed by Eve, Jaunt, Autoflight, and Beta Technologies - have two sets of stationary propellers to provide vertical lift and forward propulsion separately. And, the analysts found that the market for piloted aircraft will have a higher growth rate than that for fully autonomous or remotely piloted eVTOL aircraft, such as Wisk’s air taxi.

How did this happen, and so quickly? It is a moot point now as to which strategy allowed the eVTOL idea to germinate and bloom - because there were design precursors: a helicopter had been created by Danish inventor Jacob Ellehammer who built the Ellehammer helicopter in 1912, and well after that, in the 1960’s the cartoon plane of the Jetsons was called The Flying Car.

The design of the Jetsons’ flying car was inspired by a 1954 Ford concept car, the FX-Atmos, notable for its all-glass bubble canopy, dashboard radar screen and jet-plane-like tail fins. So, it is no great leap of contemporary imagination to conceptualize a functional hybrid blend - an air taxi that flies vertically like a helicopter and is sustainable - so the eVTOL became a 21st century idea, yet paying homage to its unique ideological diversity: the 1912 helicopter and the 1960’s Hollywood cartoon.

And yet, as with most hybrids, the eVTOL is far more than the sum of its helicopter and Hollywood cartoon parts, and far more seductive in terms of investment and travel potential.

Unlike airplanes and helicopters, a unique feature of eVTOL vehicles is how quickly travelers could theoretically move from point to point. In an era of growing sustainability needs, the eVTOL uses no fossil fuel, just clean electricity. And travelers may finally rid themselves of airport noise, confusion, and ingress/egress traffic problems. It is claimed that travelers can move, instead of from airport to airport, to a new idea: from doorstep to doorstep.

EVTOLS are now being created worldwide, and massive funding is being provided to help perfect an already perfectible idea. Charging stations, private terminals used for eVTOLS, with different interior and exterior designs, all are part of this new hyper-mobile aviation world.

The industry has already conceptualized what this future will look like. Soon, eVTOLs could replace helicopter transportation in and around urban centers. In a decade, urban areas could have hundreds of eVTOLs each, operated by Uber-style fly-share services. The fiscal upside: tens of billions of dollars projected, driven by the dream of easier travel.

Some Leading eVTOL Contenders

The companies below are some of the leading contenders building eVTOL aircraft, with developments happening around the world.

In the USA:

Archer Aviation

Founded in October of 2018, Archer is a leader in the field. On August 16, 2023, the company said it recently received its FAA Certificate necessary to begin flying its eVTOL production plane called Midnight, as it continues to hit certification milestones. Midnight is a four passenger plus pilot aircraft “optimized for back-to-back short distance trips of around 20-miles, with a charging time of approximately 10 minutes in-between.” It features 12 small propellers, 6 of which tilt to provide improved forward propulsion.

The company is listed on the NYSE with the symbol ACHR, and investors include Stellantis, Boeing and United Airlines. To date, Archer says its total funding is over $1.1 billion, offering plenty of runway to scale.

Beta Technologies

Based in Burlington, VT, Beta Technologies is developing two aircraft. Their ALIA-250 eVTOL will have a maximum range of 250 nautical miles and is designed to carry 1,400 lbs of payload or can carry six people including a pilot. Among the interested customers, vertical flight provider Bristow Group has placed a firm order for five ALIA aircraft with an option for an additional 50 aircraft.

Beta is also developing the CX300 a conventional-takeoff-and-landing (CTOL) aircraft based on the same platform. The CX300 also has firm orders and is targeted to have FAA Part 23 certification and first deliveries in 2025, ahead of the ALIA.

Joby Aviation

California-headquartered Joby Aviation was founded in 2009 and is also listed on the NYSE under the symbol JOBY.

The Joby aircraft, which has a maximum range of 150 miles (241 kilometers) on a single charge, can transport a pilot and four passengers at speeds of up to 200 mph (321 km/h). The pre-production prototype flew more than 5,300 miles, including a flight of 154.6 miles on a single charge.

The company counts Toyota as a strategic investor and has received airworthiness approval from the U.S Air Force and has a contract with the Department of Defense. In 2022 the company received a Part 135 Air Carrier Certificate, which allows Joby to operate a commercial air taxi service.

China:

AutoFlight

AutoFlight is a global high-tech company whose founders and engineers have been working on next-gen mobility for decades. They began in China, and are also now in Germany. Their Prosperity I eVTOL is designed for urban operations and can carry up to 4 passengers and a pilot. The max range is planned at 155 miles (250 km) and a cruise speed of 124 mph (200 kmh). The aircraft has 10 lift propellers and 3 push propellers. A cargo version, named CarryAll, is also in development, based on the same platform. In initial testing AutoFlight completed more than 10,000 takeoffs and landings, of an unmanned aerial vehicle, in a variety of weather conditions.

EHang

Guangzhou based EHang is developing “Passenger-grade Autonomous Aerial Vehicles” (AAV), meaning the aircraft will fly autonomously without a pilot on board. Their initial aircraft has a payload of 485 lbs (220 kg) and 19 miles (30 km) of range at the max payload. The max. speed is 80 mph (130 kmh). The aircraft has 8 foldable arms with two propellers on each arm.

EHang AAV uses 4G/5G as the high-speed wireless transmission channel to communicate with the command-and-control center, thus enabling remote control of the aircraft, when needed, and real-time transmission of flight data. EHang is listed on NASDAQ with the ticker symbol EH.

Europe

Lilium

Founded in 2015, Lilium’s headquarters and manufacturing facilities are in Munich, Germany, with teams based across the U.S and Europe. Lilium is listed on the NADAQ with the ticker symbol LILM.

The company is producing the first electric vertical take-off and landing jet. This uses “Ducted Electric Vectored Thrust” (DEVT), which are electric jet engines integrated into the moving wing flaps. The Lilium Jet can adapt for a range of customers and uses, with 4 seat or 6 seat configurations or without seats to serve the cargo market – all with one pilot. The aircraft will have a max speed of 155 mph (250 kmh) and an operating range of 109 miles (175 km) after accounting for reserves.

Lilium expects to gain type-certification and start global operations in late 2025, and has signed agreements with NetJets, Heli-Eastern, Bristow and Azul amongst others, with a total pipeline for 745 aircraft.

Volocopter

Volocopter GmbH is a German aircraft manufacturer based in Bruchsal, on the upper Rhine river.

The company has a trio of aircraft in development: the VoloCity air taxi, the VoloRegion long-haul passenger aircraft, and the VoloDrone heavy-lift cargo drone.

Their plan is to launch commercial services in Paris by summer 2024 using the 2 seater VoloCity air taxi. This aircraft has 18 rotors, a range of 21 miles (35km) and a max. airspeed of 68 mph (110 kmh).

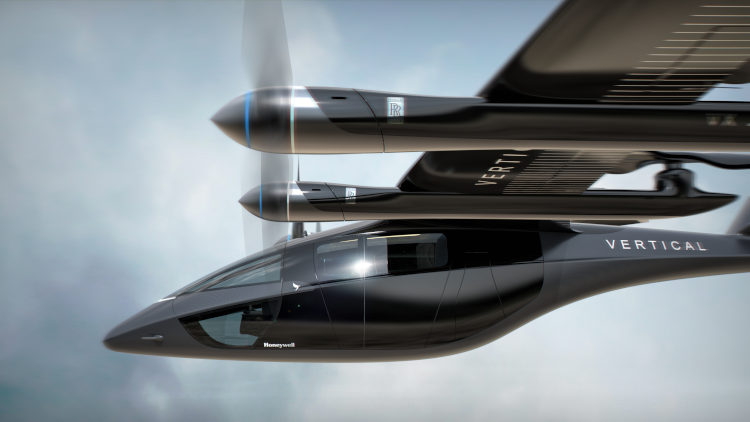

Vertical Aerospace

Bristol, England based Vertical Aerospace was founded in 2016 and is a public company listed on the NYSE with the symbol EVTL.

The VX4 aircraft is planned to carry 4 passengers and one pilot at cruise speeds of 150mph with a range of up to 100 miles. The aircraft has 8 propellers, 4 of which rotate to provide additional forward thrust. The target entry into service is towards the end of 2026.

Vertical has a conditional pre-order book for 1,400+ units worth in excess of $5bn from some of the world’s leading airlines including American, Virgin Atlantic, Air Asia and Japan Airlines.

But, the non-startups, aka, the larger, better-known aircraft companies - Airbus, Boeing, and Embraer to name just three - are also in this race, and have already built working models of eVTOLs. This is creating even greater motivation to move forwards (and upwards) for others in this nascent industry. Here is what these larger companies have done, thus far:

Airbus

They have recently created the CityAirbus NextGen, an all-electric, four-seat prototype. It has a cruising speed of 75 mph (120 kmh) and an operational range of 43 nm (80 km.) The design is based on a lift and cruise concept, which makes it ideal for urban and regional mobility programs. The vision, to create an efficient air transport service between locations in urban and suburban environments, was originated from Airbus’s idea that urban and advanced mobility could be moved into the sky, providing areas with ways to get to their destination quickly, avoiding airport confusion and delay. With decades of Airbus experience, they have successfully developed two electric VTOL models, CityAirbus and Vahana.

Embraer

Embraer, founded in 1969, has its main headquarters in São Paulo, Brazil. The company has spun out a new business unit, Eve Air Mobility which is now listed on the NYSE with the ticker symbol EVEX. Their 4 passenger eVTOL combines conventional fixed wings with rotors and pushers and will have a range of 60 miles (100 km). Eve says that their eVTOL will deliver a 6x lower cost per seat than conventional helicopters. Beyond the eVTOL's development, they are creating the services, operations and air traffic management for the whole ecosystem. They have signed agreements with Flexjet, Republic Airways, BAE Systems, United Airlines and several others who are interested in buying the aircraft and building out the infrastructure.

Boeing

Boeing subsidiary Wisk is working on the 6th generation of their autonomous, four-passenger eVTOL air taxi. The aircraft will have a range of 90 miles (144 kilometers), with reserves, and a cruising speed of 110 -120 knots. The company has operations in the U.S., New Zealand, Canada, and Australia and has completed over 1,600 test flights with full scale aircraft. The current design (pictured below) has 12 propellers, 6 of which tilt to provide improved forward propulsion.

Potential Customers & Orders

There is enormous interest from both the commercial and private aviation sectors. Many of the major players have placed orders, signed letters of intent or indicated their intentions to buy these new aircraft. Here are a few of the most prominent names

NetJets has signed a memorandum of understanding to acquire up to 150 electric aircraft from Munich based Lilium. The electric regional aircraft would provide greater options to NetJet owners for their private flights.

United Airlines said last year that it would invest in eVTOL maker Archer and placed an order for $1 billion of its aircraft. Their vision is to fly customers from Newark Liberty Airport or Teterboro to midtown New York City in 10 minutes.

California-based Joby has partnered with ANA, Japan’s largest airline, to establish an aerial ridesharing service in Japan. Toyota has also joined the partnership and is one of the largest investors in Joby.

Flexjet has placed a firm order for 200 Eve Urban Air Mobility vehicles. Expectations are one hundred of the aircraft will be used for operations in the United States and 100 will operate in the United Kingdom.

American Airlines has preordered of up to 250 Vertical Aerospace aircraft , with a commitment to prepay for 50 of the eVTOLs. American also made an investment in the company.

Vista Global, parent of Vistajet, is an investor in the Swiss hybrid-electric VTOL aircraft developer Dufour Aerospace. The company is developing both manned and autonomous aircraft.