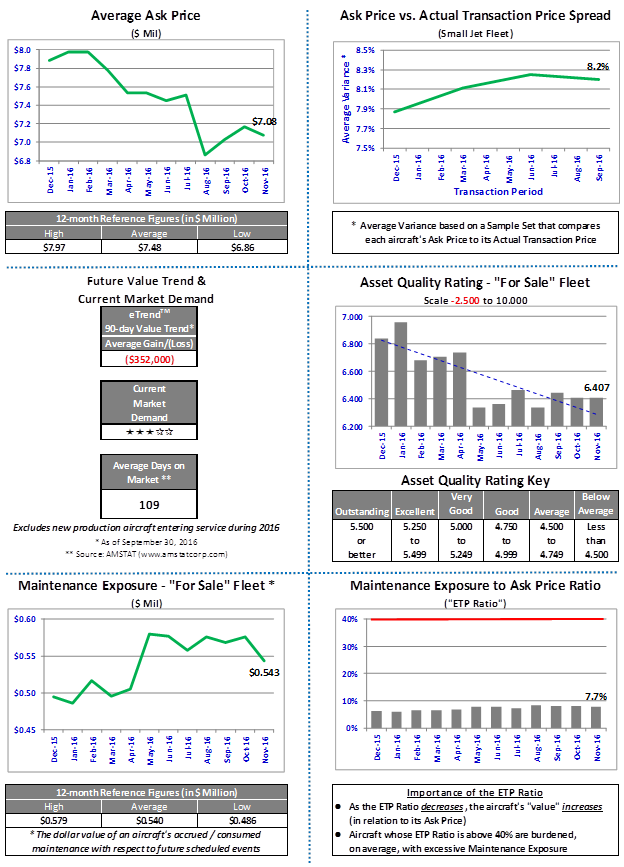

Asset Insight looked at the pricing and valuation of used Embraer Phenom 300s over the last year. The results are summarized in the charts below. Overall, there were 19 retail transactions between December 2015 and November 2016.

The full charts are all presented together, to give you a snapshot of the Phenom 300. Each individual chart is then discussed in detail below.

The average ask price is fairly self-explanatory. The typical asking price for a used Phenom 300 has fallen from $8m to about $7m over the 12 month period.

Similarly, the ask price vs. transactional price spread pretty much speaks for itself. In the period under review, it has held reasonably steady around 8%. Asset Insight used detailed analytics to determine the ask price of an aircraft and its bid/ask spreads. These include, but are not limited to, items such as market supply, demand, saturation, aircraft age, competition, utility, damage, economics, financing, trade, exclusivity, compulsion to sell, buyer/seller market strength, etc.

The Future Value Trend (or "eTrend") is intended to provide a general view of how aircraft prices are currently trending and the effect this is likely to have on average transaction values 90 days hence. The Current Market Demand is an objective view based on the Average Days on Market and the percentage of the Phenom 300 fleet listed for sale. All figures exclude new production aircraft entering service during the previous twelve months. For the Phenom 300 the average days on market, in this 12 month period, was 109 days.

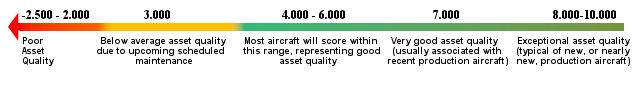

The Asset Quality Rating is a standardized scale, developed by Asset Insight, which allows you to directly compare any aircraft’s maintenance status to any other aircraft’s maintenance status. The Asset Quality Rating is calculated by averaging two measures, the aircraft’s Maintenance Rating (“ATC Score”) and Financial Rating (“ATFC Score”) - both of these are explained below. It has a scale ranging from -2.500 to 10.000. A rating of 10 is for a newly produced aircraft (see scale below).

The used Phenom 300s have been at the higher end of the Asset Quality Rating scale over the past 12 months. The score has dropped from 6.8 to 6.4 over this period. This high score partly reflects the relative newness of the Phenom 300 model.

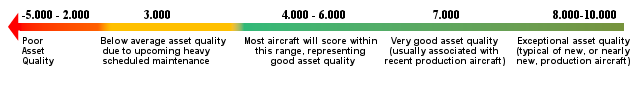

Maintenance Rating or Asset Technical Condition Score (“ATC Score”)

The “Asset Technical Condition Score” (“ATC Score”) evaluates and grades an aircraft's maintenance status, using the aircraft's (standard/typical) Scheduled Maintenance Program and puts it relative to its Optimal Maintenance Condition (based on the day it came off the production line). The ATC Score is based on a scale ranging from -5.000 to 10.000. A score of 10 is for a newly produced aircraft. Asset Insight developed this using their Asset Grading System Process.

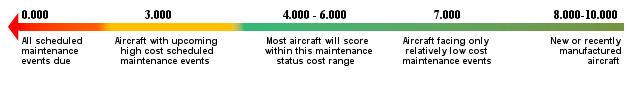

Financial Rating or Asset Technical Financial Condition Score (“ATFC Score”)

The “Asset Technical Financial Condition Score” (“ATFC Score”) evaluates and grades an aircraft's financial rating relative to its Optimal Maintenance Condition based on the Aircraft's ATC Score (see Maintenance Rating above). The ATFC Score is based on a scale from 0.000 to 10.000. Here again, a 10 is for a newly produced aircraft.

Asset Insight determines the average cost for completing each maintenance event comprising the ATC Maintenance Program. After compiling the aircraft's maintenance history, the time (calendar, flight hours or cycles) accumulated toward each individual scheduled/anticipated maintenance event is used to determine the aircraft's ATFC Score.

The two ratings differ from each other as follows. The ATC Score evaluates and grades an aircraft's maintenance status relative to its Optimal Maintenance Condition. Whereas, the ATFC Score grades an aircraft's financial condition relative to its Optimal Maintenance Condition. In other words, the ATFC Score is weighted by the estimated cost to complete each maintenance event. So the two ratings are likely to differ from each other.

As an example, let's take an aircraft with only two maintenance components. If one component was three-quarters of the way toward its overhaul while the second was one-quarter of the way toward its overhaul, their combined ATC Score would be 5.000. The ATC calculation is simply: (75% + 25%) / 2 X Perfect Score (10.000) = 5.000.

However, if the first of these components has an overhaul cost of $1,000, while the second has an overhaul cost of $10,000, their combined ATFC Score would be 2.955 (see below).

| Remaining Useful Life | Overhaul Cost | Remaining Financial Value | |

| Component #1 | 75% | $1,000 | $750 |

| Component #2 | 25% | $10,000 | $2,500 |

| $11,000 | $3,250 |

ATFC Score Calculation Methodology

Aircraft’s Financial Ratio ($3,250 / $11,000) X Perfect Score (10.000) = 2.955

Maintenance Exposure or Asset Technical Financial Exposure Value (“ATFE Value”)

The Maintenance Exposure (or “ATFE Value”) measures the aircraft’s financial exposure based on its maintenance condition. It is the financial liability accrued/consumed towards future scheduled maintenance events.

To derive the ATFE Value, Asset Insight first estimates the cost for completing each event in the ATC Maintenance Program. Then they compile an aircraft's maintenance history. Next the time (flight hours, landings/cycles, and/or calendar period) accumulated toward each scheduled/anticipated maintenance event, is used to calculate the dollar liability accrued toward that event. The ATFE Value represents the total accrued liability toward future maintenance events.

For the Phenom 300, the ATFE value has been around $0.5m during the period December 2015 and November 2016. Meaning that there is roughly $500,000 of accrued maintenance on each aircraft. The high was $579,000 and the low was $486,000.

Maintenance Exposure to Ask Price Ratio (“ETP Ratio”)

The Maintenance Exposure to Ask Price Ratio (or “ETP Ratio”) is calculated by dividing the aircraft’s ATFE Value (the liability accrued with respect to future scheduled maintenance events) by its Ask Price. As the ETP Ratio decreases, the aircraft’s “value” increases (in relation to its Ask Price). Aircraft whose ETP Ratio is 40% or greater are believed to have accrued an excessive level of maintenance Asset Exposure (ATFE Value) in relation to their Ask Price.

For the Phenom 300 the typical ETP Ratio was only 7.7% at November 2016, so well below the 40% level.

The author is President & CEO of Asset Insight LLC, the company established the “Asset Grading System Standard” for aircraft. He has over 35 years of aviation industry experience within corporate & general aviation, major airlines, fixed-wing & rotary OEMs, technical services providers, and financial services companies.