Destination clubs, residence funds and luxury travel clubs provide their members with access to multiple luxury vacation homes, located all over the world. The homes are typically multi-million dollar residences, and are sited in major cities, at beaches, in mountains and leisure locations.

Membership of the clubs is an alternative to buying a second home. The clubs are sometimes also compared to, or even mixed up with, private residence clubs, but there are several key differences between the two.

If you're just starting out learning about the clubs and funds read the overview and the glossary. Then you can start to compare them in the comparison table. One way to financially compare them is using a cost per night calculation and we've provided downloadable spreadsheets for these calculations. Here are the top reasons to join a club, but they are not for everybody and here are the reasons not to join.

And for a real in-depth look at the clubs, their homes and services, comparisons to alternatives and questions to consider before joining, download our Guide for Prospective Members.

The latest news and research on the clubs is included below.

- Details

- Written by Nick Copley

SherpaReport spoke with Greg Salley, Managing Director of Equity Residences, about how they select real estate investment opportunities and add value to their luxury real estate investment funds. The discussion talked through their purchase strategy and value-added upgrades.

- Details

- Written by Nick Copley

The Calgary based destination club has added a ski in, ski out property at Fernie Alpine Resort in southeast British Columbia. At the same time several new members joined from the club’s waitlist.

- Details

- Written by Fiona Young-Brown

In 2019, luxury destination club Inspirato launched their one-of-a-kind subscription-based Inspirato Pass program. Recently, the company announced that the original Inspirato Club membership would also be transitioning into a subscription-based program. SherpaReport reached out to Brent Handler, CEO and Founder of Inspirato, to learn more about the changes and to find out how the company has been weathering the coronavirus pandemic.

- Details

- Written by Nick Copley

Every owner association consists of 21 families, who own 5 beautiful vacation properties at 5 attractive destinations together. Each of the five vacation properties are worth about four times more than the single investment per family.

- Details

- Written by Nick Copley

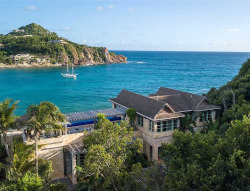

SherpaReport traveled down to St John in the US Virgin Islands with team members from Equity Residences, to see the steps they go through in preparing and launching a new home. The Equity Platinum Fund had closed on the home just days before we arrived, and the first guests were due a few days later, so there wasn’t a lot of time to make sure the home was in perfect shape.

- Details

- Written by Fiona Young-Brown

Inspirato recently began re-opening its homes in the wake of the coronavirus pandemic. The luxury hospitality company has instituted a new enhanced cleaning program to ensure safety for members. We took a look at the measures in place that allow Inspirato to live up to their promise of “taking care of our members like no one else.”

- Details

- Written by Nick Copley

Equity Residences launched its first luxury vacation home investment fund, the Equity Villa Fund, in 2012. Now it’s launching the first-ever vacation home fund compatible with “like kind” 1031 exchanges - the Mauna Lani Residence Fund.

- Details

- Written by Nick Copley

The equity residence fund has recently opened new homes. For a couple of these homes the fund did renovations after acquiring them, in order to bring them up to the funds standards. The homes represent a mix of beach, mountain and city residences for the exclusive use of investor members.

- Details

- Written by Fiona Young-Brown

Last year, luxury destination club Inspirato launched a new one-of-a-kind program – Inspirato Pass. The monthly subscription program offers unlimited access to all sorts of membership benefits, including exclusive vacation properties, hotel rooms, and custom travel experiences. SherpaReport checked in with Inspirato for an update on Inspirato Pass and to see what customers think.

- Details

- Written by Nick Copley

Equity Residences continues to add new residences in popular beach destinations in both Hawaii and the Caribbean. Managing Director Greg Salley told us about the two newest acquisitions in Providenciales, Turks and Caicos, and Poipu, Kauai. Both destinations are in high demand by the Equity Platinum Fund investors.

- Details

- Written by Nick Copley

Early last year Equity Residences offered a trial membership program for a few months, and this year it’s back on offer. This was largely in response to requests from interested investors, who wanted to try the Equity Platinum Fund vaction homes, before fully investing.

- Details

- Written by Nick Copley

To continue the momentum from Equity Estates Funds I, II, and III, CEO and Founder, Philip Mekelburg announced the launch of Equity Estates Fund IV, an alternative investment that buys luxury vacation residences for use by the investors.

- Details

- Written by Nick Copley

Equity Residences’ Equity Platinum Fund continues to grow their vacation home portfolio with their latest residence on St John in the US Virgin Islands.

- Details

- Written by Nick Copley

The luxury travel club Rocksure has two supercar journeys planned for members in 2020. In June, members will travel around the highlands of Scotland for 10 nights, and in September will drive down through France ending in Monte Carlo. The trips include a choice of some of the world’s most glamorous cars including an Aston Martin DB9 Volante, Ferrari F430 Spider, Audi R8 V10 Spyder or Porsche 911 Turbo Cabriolet.

- Details

- Written by Fiona Young-Brown

Traveling with children can bring its own challenges, from ensuring that they are safe to providing enough activities that parents don’t hear the dreaded moan “I’m bored”. For members at destination clubs the concierge services are there to take care of everyone’s needs, including the younger members of the family. SherpaReport spoke to several destination clubs to find out what they have to offer families and groups traveling with children.

- Details

- Written by Nick Copley

In a new twist to its vacation home funds, Equity Residences has launched a fund that is focused on buying homes at Mammoth Mountain in Southern California.

The earlier funds from Equity Residences have bought homes in a variety of locations across North America, so this is the first of their funds to be aimed at just one location.

- Details

- Written by Nick Copley

Equity Estates Fund III, announced today that they successfully welcomed over $8.5 million in new capital contributions from Residential Club Holdings, (RCH) members. RCH is made up of members from the old Abercrombie & Kent Private Residence Club, who for the past six years, had been cared for by Exclusive Resorts.

- Details

- Written by Fiona Young-Brown

Luxury destination club Inspirato recently introduced a subscription-based program to its membership offerings. With Inspirato Pass, subscribers can gain unlimited access to exclusive vacation properties, five-star hotel rooms and unique travel experiences, all for one set monthly fee, with no additional taxes or hidden charges.

- Details

- Written by Fiona Young-Brown

Since its launch in 2002, Exclusive Resorts has grown to become one of the leading destination clubs. Members, who have the options of joining either a 30-year or 10-year plan, gain access to a portfolio of more than 400 luxury residences in more than 120 destinations around the globe.

Members also enjoy an array of additional benefits, such as Gold Medallion status with Delta’s SkyMiles, access to Delta private jets, Avis Chairman’s Club membership and priority entry to a variety of restaurants. But one of the most impressive benefits of membership is access to a series of curated luxury once-in-a-lifetime vacation experiences.

- Details

- Written by Nick Copley

SherpaReport recently caught up with Brian Anderson, the new CEO and current Chairman of the Board at Destination M. We talked about the destination club, its plans, membership structure, home locations and more.

- Details

- Written by Fiona Young-Brown

A new program launched by Inspirato last summer is allowing luxury home buyers and owners to partner with the company. Billed as offering “all of the benefits of luxury vacation homeownership, with none of the headaches”, Inspirato Real Estate is a way of building the Inspirato Collection of vacation properties while making it easier for owners to rent out their homes.

- Details

- Written by Nick Copley

The Solstice Collection offers its members access to some unique artisanal second homes, spread around the world. SherpaReport recently asked how these homes are being used, which ones are most popular and which ones the members prefer.

Latest Club Research

-

Reviewing Luxury Vacation Home Alternatives

Reviewing Luxury Vacation Home Alternatives - Additional Benefits at Equity Destination Clubs

-

Who Joins a Destination Club – The Demographics

Who Joins a Destination Club – The Demographics - Guide to Destination Clubs Has Been Updated

- The Pain of Owning a Vacation Home

- Time is the Ultimate Luxury

- Destination Clubs - Should I Rent or Buy?

-

Top 5 Reasons NOT to Join a Destination Club

Top 5 Reasons NOT to Join a Destination Club -

The Top 7 Reasons to Join a Destination Club

The Top 7 Reasons to Join a Destination Club - Increasing Interest in Purchasing Access to a Shared Vacation Home

Latest Club News

-

How Value-Added Remodeling Transforms Equity Residences Homes

How Value-Added Remodeling Transforms Equity Residences Homes -

Inspirato Rewards, New CEO and More

Inspirato Rewards, New CEO and More -

Exclusive Resorts Expands Partnerships & Destinations

Exclusive Resorts Expands Partnerships & Destinations -

The Top 10 Reasons to Join a Travel Club

The Top 10 Reasons to Join a Travel Club -

The August Collection - A New European Co-Ownership Group

The August Collection - A New European Co-Ownership Group -

Equity Residences Adds Home Overlooking Central Park & Completes Belize Remodel

Equity Residences Adds Home Overlooking Central Park & Completes Belize Remodel -

Why Members Joined Exclusive Resorts

Why Members Joined Exclusive Resorts -

Inspirato Launches JauntLiving and Inspirato for Good.

Inspirato Launches JauntLiving and Inspirato for Good. -

Further Growth at Destination M With New York Home

Further Growth at Destination M With New York Home -

Equity Estates and the Introduction of Fund VI: The Philip Mekelburg Interview

Equity Estates and the Introduction of Fund VI: The Philip Mekelburg Interview