Private Jets and Business Aircraft

With the well documented issues in commercial flying more and more people have found reasons to turn to private aircraft.

There are a variety of options to consider. The starting point is how often you want to fly privately.

If you only fly a few hours a year then on demand aircraft charter is probably the best way to go. As your number of hours of private flying increases look at charter cards and fractional cards.

Once you reach about 50 hours of flying a year then fractional aircraft ownership can start to make sense and above 300 or so hours per year whole ownership is worth looking into. Here is some core information to help you understand the options.

All of the major providers have expanded over the last few years. Many now offer a wide range of products and solutions to meet the needs of various clients. If you're looking at the different options and would like a good general overview then download our free Guide to Private Aviation, which includes details on charter, jet cards and fractional ownership. For detailed side by side comparisons of the leading jet card and fractional providers, a directory of charter operators, and our Aircraft Buying Guide then sign up for membership.

The latest news and research on private jets and aircraft is included below.

- Details

- Written by Nick Copley

Flexjet is adding 22 more mid- and super midsized private jets to its global fractional fleet by the end of the year. Together with large-cabin aircraft on order, this will bring the fleet to 270 jets by year-end 2023. The increasing capacity is also allowing Flexjet to restart jet card sales.

- Details

- Written by Nick Copley

One of the largest private aviation providers, flyExclusive, has expanded the features in both its Jet Club and fractional program. These will allow members to benefit from increased savings and flexibility. The changes include reduced peak days, reduced prices, discounted short-notice premiums and a $100,000 flight credit for new fractional members. The offers are available now through Labor Day, September 4, 2023, to all new and current members.

- Details

- Written by Nick Copley

Fractional HondaJet operator Jet It has grounded all its aircraft and has laid off all staff. Jet It pointed the finger at maintenance issues with their aircraft, but questions abound about the financial position of the company.

- Details

- Written by Nick Copley

Vista Global Holdings, parent of VistaJet and XO, grew revenue to about $2.5bn in 2022 and says expansion has continued with “high double-digit revenue growth” producing a record first quarter in 2023. However the Financial Times (FT) recently reported on the billions of dollars of debt and four years of losses at the private jet operator. Vista CEO Thomas Flohr stresses the company has a very positive EBITDA (Earnings before interest, taxes, depreciation and amortization) and its focus is cash flow.

- Details

- Written by Nick Copley

The first iteration of the PC-12 single engine turboprop was approved in 1994. Manufacturer Pilatus just had a handover ceremony for the 2,000th PC-12 which was sold to fractional operator PlaneSense, its longstanding US customer and the operator of the world’s largest civilian fleet of Pilatus PC-12s and PC-24 jets.

- Details

- Written by Nick Copley

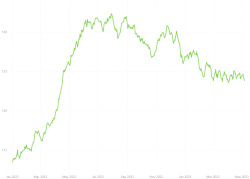

The cost to charter a private jet in the United States has been dropping, across all cabin classes, since the peak levels in mid-2022. SherpaReport looked at data from charter marketplace provider Avinode, to assess the impacts on various cabin sizes.

- Details

- Written by Nick Copley

Private aviation solutions provider Magellan Jets offers both model specific jet cards and also category cards, as well as providing membership options. It has just lowered the hourly rates on its cards and memberships.

- Details

- Written by Nick Copley

The largest fractional jet operator, NetJets has signed a new deal with aircraft manufacturer Embraer for up to 250 mid-size Praetor 500 jets. The deal includes a comprehensive services and support agreement and is valued in excess of US $5 billion. Deliveries are expected to begin in 2025, and will be NetJets' first time offering the midsize Praetor 500 to customers.

- Details

- Written by Susan Kime

It is unusual to find a private jet charter company whose founder wishes to remain boutique, small and serves specific demographic needs, but Advanced Aviation Team fits this rare criterion.

Gregg Brunson-Pitts is the founder and CEO of Advanced Aviation Team. Since 2015, he has been managing charter aircraft solutions for national leaders, presidential candidates, heads-of-state, celebrities and government agencies, along with their families, and with or without their dogs.

- Details

- Written by Nick Copley

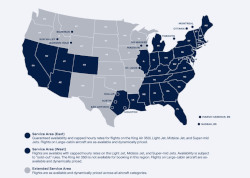

Private aviation provider Wheels Up has been making some major changes recently. Founder and CEO Kenny Dichter has stepped down, from the CEO role. Other new management has been brought in, and the company has made changes to the member programs including the service areas.

- Details

- Written by Nick Copley

Flying private can be a luxurious and seamless experience thanks to the support of FBOs, or Fixed-Base Operators. FBOs are private terminals that cater exclusively to private aviation, offering a range of services to private aircraft owners and their passengers.

- Details

- Written by Nick Copley

The latest private flight data shows that overall global private jet activity in Q1 of 2023 was down 4% compared to Q1 2022, but still up 15% compared to (pre-pandemic) Q1 of 2019, according to WingX. This article looks at the split of activity for North America and Europe and between Part 91k fractional, Part 135 charter and Part 91. The North American fractional market is proving the most resilient with flight numbers continuing to increase.

- Details

- Written by Nick Copley

The General Aviation Manufacturers Association (GAMA) reported global sales of 712 new business jets in 2022, up slightly from the 710 new jets sold in 2021. Sales of piston and turboprop airplanes also increased, as did sales of new helicopters. Overall new aircraft deliveries were valued at $26.8 billion, an increase of 6.0%.

- Details

- Written by Fiona Young-Brown & Nick Copley

VeriJet is a relatively new player in the private air charter market, but it’s carving out an interesting niche. As the largest operator of the low-cost Cirrus SF50 Vision Jet the firm is expanding across the USA. SherpaReport talked to CEO Richard Kane about the company, the plane, charter services and growth. Since starting in 2020 with a fleet of six Cirrus SF50 Vision Jets, Verijet has grown rapidly and hopes to eventually have a fleet of 130 or more aircraft.

- Details

- Written by Nick Copley

In October 2022, private aviation company Flexjet had announced plans that it intended to become a public company, through a merger with the special purpose acquisition company (SPAC) Horizon Acquisition Corp II. The two companies just agreed to terminate this arrangement and as a result of the termination, Flexjet will remain a private company.

- Details

- Written by Susan Kime

AirSprint is Canada's largest fractional jet operator and North America's fourth largest, logging 27,333 flight hours according to ARGUS TraqPak data. The company saw 43% growth from 2021 to 2022 and has significantly added to its fleet over the last few years. SherpaReport spoke to AirSprint's President and CEO, James Elian, about the recent growth and plans for the future.

- Details

- Written by Nick Copley

Private Jet Company Volato achieved total sales of over $103 million in 2022, its first full year of operations, a 627% increase over its 2021 results. The Hondajet operator now offers a full suite of private aviation programs which have been rolled out over the last year. SherpaReport spoke to CEO and co-founder Matt Liotta.

A hundred million dollars of revenue in your first complete year is impressive for any business. So, we were curious to find out what Matt Liotta attributed this success to.

- Details

- Written by Nick Copley

One of the largest private aviation providers, Wheels Up, had revenue of $1.6bn in 2022, up 32% from 2021. The number of “Active Members” grew 5% to 12,661 but the net loss also increased significantly. The company says it is now focused on profitability after many years of rapid growth.

- Details

- Written by Nick Copley

Fractional aircraft flights reached a new record level in 2022, with hours flown growing even more than charter flights or wholly owned flights, according to data from ARGUS TRAQPak. These figures confirm the trend of significant growth across the whole of private aviation in the last two years.

We expect the next 12 months will continue to be very busy for the fractional market. The reasons are multifaceted, but key trends for increased activity relate to a wider variety of aircraft, shorter wait times to gain access to fractional ownership, a more favorable buyer’s market, flexible structures, and an increased focus on sustainability.

- Details

- Written by Nick Copley

flyExclusive, a leading provider of private jet charter and jet cards, has introduced Platinum Jet Club. This new option allows members to access a completely fixed price program on light, mid size and super-mid size jets, with hourly and daily fees locked for 12 months.

- Details

- Written by Nick Copley

Fractional jet provider Volato is offering a new structure for potential HondaJet owners. Share buyers can choose to pay no monthly management fees and instead pay a higher hourly usage charge.

This no monthly management fee program is designed for owners who fly infrequently but require guaranteed availability when they do fly, while also desiring the full benefits of aircraft ownership.

- Details

- Written by Nick Copley

Private aviation provider Magellan Jets expanded its portfolio of private aviation solutions in 2022. Among other initiatives, they launched a new aircraft sales & management division, moved to a new corporate headquarters with a new flight operations center, and recently opened the company’s first private jet terminal. As a result, the company grew gross revenue to a total of $120 million last year and is projecting $140 million for 2023.

Latest Aviation Research

- Updated Aircraft Buying Guide

- What are FBOs And What Services Do They Provide

- The Largest Fractional Aircraft Operators in 2022

- New Guide to Buying a Private Aircraft

- Used Business Jet Sales Are Surging

- Chartering a Private Aircraft: Primer for First Time Buyers

- Negotiating Fractional Jet Contract Terms

- An Introduction to Flying on Private Aircraft

- New Business Jet Sales Up in 2018

- Buying a Jet for Charter Revenue