As vaccination rates rise and restrictions are being eased, more people are turning to private air travel, both for leisure and business purposes.

The ARGUS TRAQPak numbers showed private aviation flight numbers reached pre-pandemic levels in March. That same month Part 135 charter set a record for monthly flights with just over 104,000 according to ARGUS.

Business Traffic Booming

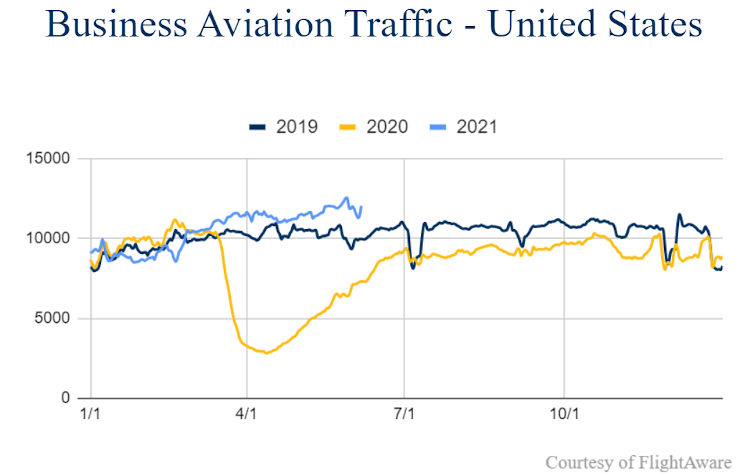

Flight tracking data provider FlightAware has continued to see growth in private and business aviation activity in the US and worldwide. The FlightAware definition of business aviation is “any turbine general aviation flights that are not commercial or cargo airlines.”

The most recent data indicates that business aviation traffic in the US has not only recovered from last year’s slump; it has also risen to rates well above those of 2019. For the week of May 31 - June 6, the average number of private aviation flights per day in the United States was 12,039, compared to 7,311 in 2020 and 9,965 in 2019. All told, this is a 64.67% increase over last year, and a notable 20.81% increase over pre-pandemic 2019 figures.

Daniel Baker, CEO of FlightAware states: "For over four months, business aviation traffic in the United States has exceeded 2019 numbers. Memorial Day weekend was no exception, with flight traffic as high as +19% when compared to the holiday weekend in 2019."

This reinforces what many private jet providers have been saying as safety concerns cause people to turn away from commercial flights to other aviation alternatives. For instance fractional and jet card provider NetJets notes “Our daily flight volumes are at a record high and continue to grow. Likewise, a recent study tells us that most Owners plan to fly more, whether for business or pleasure.” The charter and jet card provider Air Partner told SherpaReport "Our private jet volumes are up 15% from pre-pandemic Q1 2019, and this will only rise more as business travel continues to come back."

Looking at requests in their charter marketplace, Avinode said "demand is up year-over-year from all fifty US states." But also added "demand to further afield is still slow; demand for transatlantic travel from the US is down on last year."

Further growth is expected. A new study conducted by WSJ Intelligence and VistaJet on the future of business travel reveals that 81% of global leaders say that business travel will be more critical than ever. Among respondents who take eight or more private flights a year, 60% plan to significantly increase in-person meetings. The vast majority — 87% of respondents — said their time is very valuable. They look for opportunities to maximize results, and 74% said that flying private is a driver of efficiency and success.

Commercial Air Traffic Still Down

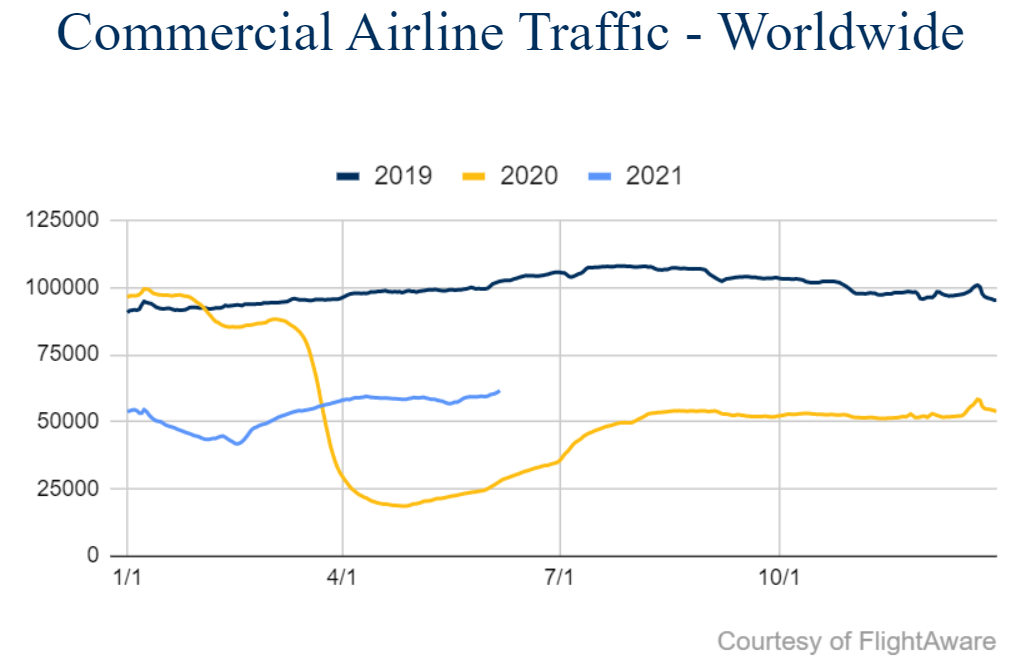

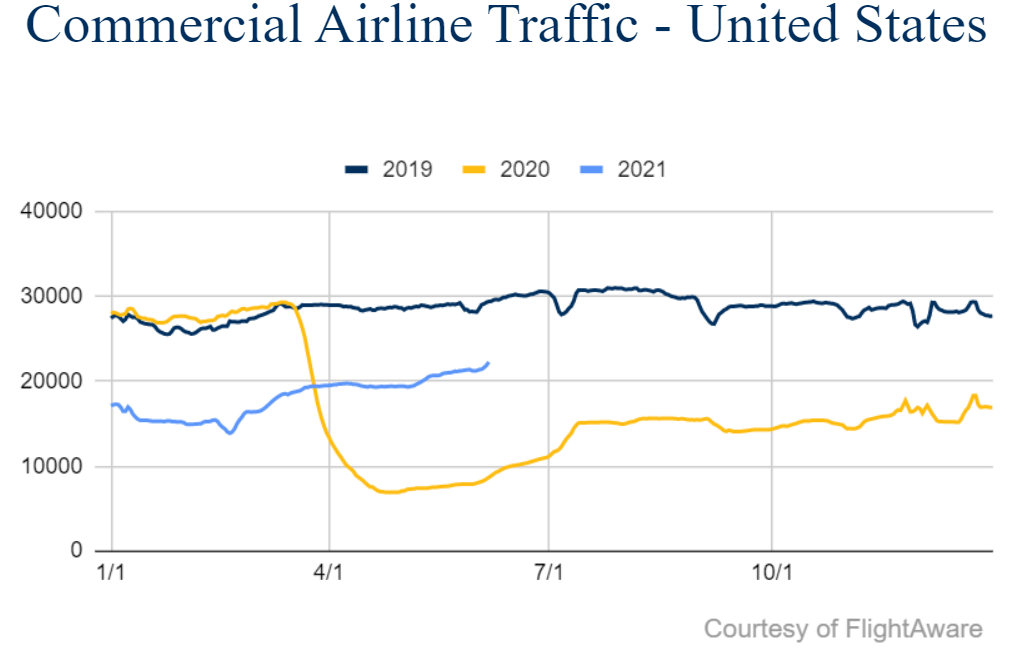

Meanwhile, commercial air traffic is still lagging. Although flight figures are much improved when compared to last year’s pandemic numbers, they have yet to catch up to 2019 levels, both in the United States and worldwide.

Commercial flights in the US during the first week of June 2021 averaged 22,278 per day, a vast increase over the daily average of 8,685 flights this time last year, but still below the average 29,416 in 2019. Compared to 2019, US traffic is down 24.27%. Worldwide, the drop is 39.77%.