Private Jets and Business Aircraft

With the well documented issues in commercial flying more and more people have found reasons to turn to private aircraft.

There are a variety of options to consider. The starting point is how often you want to fly privately.

If you only fly a few hours a year then on demand aircraft charter is probably the best way to go. As your number of hours of private flying increases look at charter cards and fractional cards.

Once you reach about 50 hours of flying a year then fractional aircraft ownership can start to make sense and above 300 or so hours per year whole ownership is worth looking into. Here is some core information to help you understand the options.

All of the major providers have expanded over the last few years. Many now offer a wide range of products and solutions to meet the needs of various clients. If you're looking at the different options and would like a good general overview then download our free Guide to Private Aviation, which includes details on charter, jet cards and fractional ownership. For detailed side by side comparisons of the leading jet card and fractional providers, a directory of charter operators, and our Aircraft Buying Guide then sign up for membership.

The latest news and research on private jets and aircraft is included below.

- Details

- Written by Fiona Young-Brown

The HondaJet has proven to be a popular light jet, since the first one was delivered to a customer in 2015. The updated HondaJet Elite was launched in 2018, offering a new Garmin G3000 flight deck, improved performance and an upgraded interior. In May 2021, the company announced new upgrades to the design with the HondaJet Elite S which increased the aircraft’s maximum takeoff weight. Here is a look at the costs to own and operate this sought after light jet.

- Details

- Written by Susan Kime

Jet Edge Reserve members will now be able to fly coast-to-coast on a Challenger starting at $39,900. In addition, Jet Edge is announcing a new transcontinental program to include non-coastal hubs like Las Vegas, Salt Lake City, Bozeman, Aspen, Nashville and Scottsdale among others for flights of four hours or more, also starting at $39,900.

- Details

- Written by Fiona Young-Brown

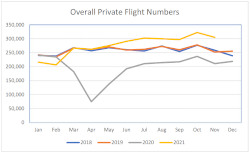

Private aviation flight numbers started to hit new highs earlier in 2021. The most recent figures show record setting days over Thanksgiving weekend and a record month. Growth is expected to continue.

- Details

- Written by Nick Copley

Over the last few months, Wheels Up executives have been presenting and discussing plans for their vision to create a “Marketplace” for private aviation. SherpaReport sat in on the presentations and talked to company executives. It’s a bold vision, and to some extent the latest results from the company show progress towards the goal.

- Details

- Written by Nick Copley

Private aviation is going through an enormous imbalance of supply and demand. Lots of people want to fly privately, but there just aren’t enough aircraft. Adding to this are various supply chain problems, service issues, staffing shortages and the net result is prices are going up and some service levels are impacted.

- Details

- Written by Nick Copley

One of the leading private aviation companies, Flexjet, is planning a 40% increase in the size of its fleet by the end of 2022. It is also growing its staff numbers and expanding its ground support and infrastructure.

- Details

- Written by Nick Copley

SherpaReport sat down with Jim Segrave, founder of LGM Enterprises, flyExclusive’s parent company. We talked through expansion and growth at the large jet charter operator, the impact of COVID and future plans.

- Details

- Written by Nick Copley

With today’s enormous demand for private aviation, NetJets has announced that it is adding over 125 aircraft by the end of 2022. This includes more than 25 by spring. The overall investment is approximately $2.5 billion.

- Details

- Written by Nick Copley

SherpaReport sat down with George Antoniadis, the founder and CEO of PlaneSense, to discuss recent growth and expansion in their fractional aircraft programs. The company operates both the Pilatus PC-12 turboprop and PC-24 light jet and has been adding new aircraft to its fleet.

- Details

- Written by Fiona Young-Brown

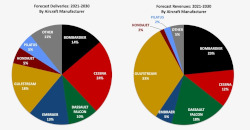

As a second year affected by the COVID pandemic draws to a close, we have seen demand for private aviation services reaching new highs. At the same time, supply chain issues are causing problems in some areas. We look at private aviation industry forecasts for the coming ten years to see what lies ahead. Included are insights from manufacturer Honeywell and analysts at JETNET iQ. Also included is information from Jetcraft’s five year forecast for the pre-owned business aviation market.

- Details

- Written by Fiona Young-Brown

For 20 years, Tradewind Aviation has been providing private air charter services in the northeastern US, the Caribbean, and further afield. Recently they earned fifth place in the coveted Conde Nast Reader’s Choice Awards for best airline in the United States, a first for any private aviation company. The SherpaReport spoke to founders Eric and David Zipkin recently to learn more about the company.

- Details

- Written by Nick Copley

Private aviation company Air Partner has a new mobile app for members of its JetCard program. It is also increasing the notice period to request aircraft, is increasing the hourly rates on smaller jets and saying that for certain days over the end of year holidays in 2021 only charter rates will be available. These latter changes all reflect the unprecedented market demand for private aircraft this year.

- Details

- Written by Nick Copley

Aircraft manufacturer Embraer and private aviation company NetJets have just signed a deal for up to 100 additional Phenom 300 light jets, with a value in excess of $1.2 billion. The Phenom 300 is one of the most popular aircraft in the NetJets fleet.

- Details

- Written by Nick Copley

Jet Edge, one of the largest private aviation operators, has received a total of $190m in funding from KKR and is adding 27 Bombardier Challenger 300/350 and Gulfstream G450 aircraft to its fleet.

- Details

- Written by Nick Copley

In the first half of 2021, VistaJet sold over 8,000 new annual subscription hours, an increase of 67% on 2020 figures and a 41% rise over 2019 levels. XO Deposit Members were up 82%, with three times as many sales in the period compared with 2020.

The Vista Global Group’s on demand services also performed strongly during the period, with a year-on-year growth of 67% across all markets, and 55% up on 2019.

- Details

- Written by Nick Copley

Private aviation company Wheels Up (NYSE:UP) reported its first set of results as a public company, following on from its SPAC listing. The second quarter revenue increased 113% year-over-year to $285.6 million, live flight legs increased 146% year-over-year to 18,234 and active members grew to 10,515 representing 47% year-over-year growth.

- Details

- Written by Nick Copley

As of today, NetJets says “all requests for the NetJets Card Program will be placed on a waitlist.” This temporary pause for all jet cards extends the announcement from only a few weeks ago, of a pause on just the light cabin Citation XLS and Phenom 300.

- Details

- Written by Nick Copley

Citing record contract utilization by existing fractional owners, NetJets says flight demand is currently exceeding all other highs in their 57-year history. Simultaneously it has “exhausted the production capacity of some OEM partners.” As a result, it is temporarily pausing sales of new fractional shares, leases and jet cards on the light cabin Citation XLS and Phenom 300, which are the smallest planes in its fleet.

- Details

- Written by Fiona Young-Brown

In March this year, SherpaReport looked at how the market for new business jets showed signs of a strong recovery, from a pandemic induced fall in 2020. In this article, we follow up by exploring the current, booming state of the market for pre-owned business jets.

- Details

- Written by Nick Copley

Private aviation company Air Partner has seen a 56.8% increase in JetCard bookings globally from 1 February to 30 June compared to the same period last year. The number of new members is also up 36.8% year-on-year, while customer deposits are up 85.2%.

- Details

- Written by Nick Copley

The new Unlimited Access Program gives G650 fractional jet shareholders access to the entire Flexjet fleet. G650 owners can pick the most appropriate aircraft size for any given flight and choose either direct account credits or additional flight hours.

- Details

- Written by Fiona Young-Brown

In the world of private aviation management, charters, maintenance, and FBO services, Clay Lacy Aviation is one of the longest-running and most experienced companies you will find. Founded in 1968, the company began by offering charter services from Van Nuys Airport in Los Angeles. At the time, it was the only such company west of the Mississippi. Clay Lacy then added additional services: aircraft management, maintenance, and in 1981 the world’s first all-jet FBO. To learn more about recent developments at the company, including the pandemic effects, SherpaReport spoke with Scott Cutshall, SVP Development and Sustainability at Clay Lacy’s FBO in Orange County.

Latest Aviation Research

- Updated Aircraft Buying Guide

- What are FBOs And What Services Do They Provide

- The Largest Fractional Aircraft Operators in 2022

- New Guide to Buying a Private Aircraft

- Used Business Jet Sales Are Surging

- Chartering a Private Aircraft: Primer for First Time Buyers

- Negotiating Fractional Jet Contract Terms

- An Introduction to Flying on Private Aircraft

- New Business Jet Sales Up in 2018

- Buying a Jet for Charter Revenue